39 ytm zero coupon bond

Current Yield: Bond Formula and Calculator [Excel Template] Since the annual coupon depends on the bond’s original face value (FV), the coupon can be calculated by multiplying the coupon rate by the FV of the bond. Annual Coupon = $60; However, the current market prices of the bonds are all different, with the bonds trading below par, at par, and above par, respectively: Discount Bond = $950; Par Bond ... Zero-Coupon Bond - Definition, How It Works, Formula What is a Zero-Coupon Bond? A zero-coupon bond is a bond that pays no interest and trades at a discount to its face value. It is also called a pure discount bond or deep discount bond. U.S. Treasury bills are an example of a zero-coupon bond. Summary A zero-coupon bond is a bond that pays no interest.

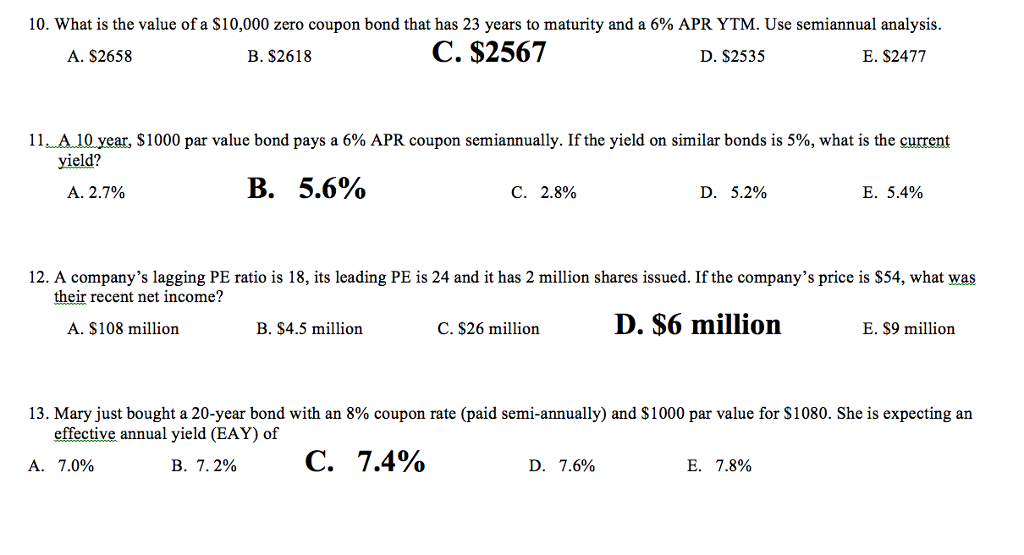

Solved What is the yield to maturity (YTM) of a zero ... What is the yield to maturity (YTM) of a zero coupon bond with a face value of $1,000, current price of $770 and maturity of 4 years? Recall that the compounding interval is 6 months and the YTM, like all interest rates, is reported on an annualized basis. (Allow two decimals in the percentage but do not enter the % sign.) STEP BY STEP

Ytm zero coupon bond

Zero Coupon Bond - Investor.gov The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years. These long-term maturity dates allow an investor to plan for a long-range goal, such as paying for a child's college education. With the deep discount, an investor can put up a small amount of money that can grow over many years. Yield to Maturity (YTM) Definition - investopedia.com The bond is currently priced at a discount of $95.92, matures in 30 months, and pays a semi-annual coupon of 5%. Therefore, the current yield of the bond is (5% coupon x $100 par value) / $95.92... Problem Set # 12 Solutions - University of New Mexico This year's price is 1,000. since the YTM equals the coupon rate. Calculator entries for next year's price are N = 7, I/Y = 7, PMT = 60, FV = 1,000, CPT PV -46.11 8. A bond pays a semiannual coupon, and the last coupon was paid 61 days ago. If the annual coupon payment is $75, what is the accrued interest? (Assume 182 days in the 6-month period.)

Ytm zero coupon bond. Zero Coupon Bond Yield Calculator - YTM of a discount bond A Zero Coupon Bond or a Deep Discount Bond is a bond that does not pay periodic coupon or interest. These bonds are issued at a discount to their face value and therefore the difference between the face value of the bond and its issue price represents the interest yield of the bond. Bond vs Loan | Top 7 Best Differences (with Infographics) Government bond yields Bond Yields The bond yield formula evaluates the returns from investment in a given bond. It is calculated as the percentage of the annual coupon payment to the bond price. The annual coupon payment is depicted by multiplying the bond's face value with the coupon rate. read more are likely to be low and are a safer ... Zero Coupon Bond Yield - Formula (with Calculator) A zero coupon bond is a bond that does not pay dividends (coupons) per period, but instead is sold at a discount from the face value. For example, an investor purchases one of these bonds at $500, which has a face value at maturity of $1,000. Solved The YTM for a zero-coupon bond is 10.50% for a 1 ... The YTM for a zero-coupon bond is 10.50% for a 1-year bond and 11.2% for a 2-year bond. You wish to make a 1-year investment and obviously can buy the 1-year bond and hold it to maturity. Suppose, however, that you think the yield curve will remain the same throughout the future.

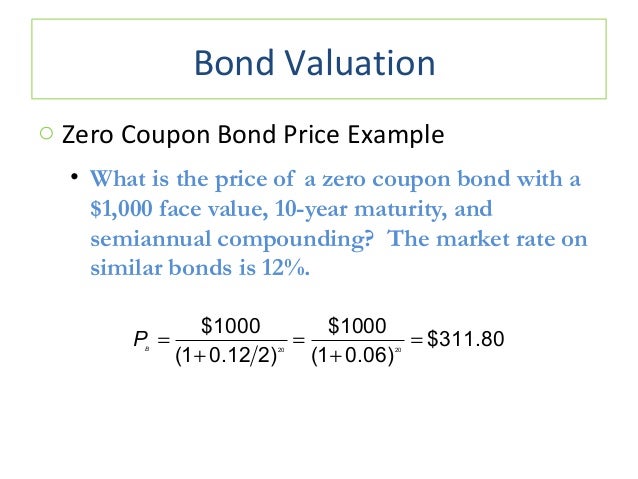

Zero Coupon Bond Definition and Example | Investing Answers What are Zero Coupon Bonds? A zero coupon bond is a bond that makes no periodic interest payments and therefore is sold at a deep discount from its face value. The buyer of the bond receives a return by the gradual appreciation of the security, which is redeemed at face value on a specified maturity date. The Zero Coupon Bond: Pricing and ... - Financial Pipeline Both coupons and residuals are "zero coupon bond" or "zero". Investment dealers exist to make a profit so the strips or zeros are sold to investors. The dealers obviously make a healthy profit on stripping bonds. The profit is created by the way the "Yield to Maturity" (YTM) of a bond is calculated. Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =. Solved What is the yield to maturity (YTM) of a zero ... What is the yield to maturity (YTM) of a zero coupon bond with a face value of $1,000, current price of $920 and maturity of 3.5 years? Recall that the compounding interval is 6 months and the YTM, like all interest rates, is reported on an annualized basis.

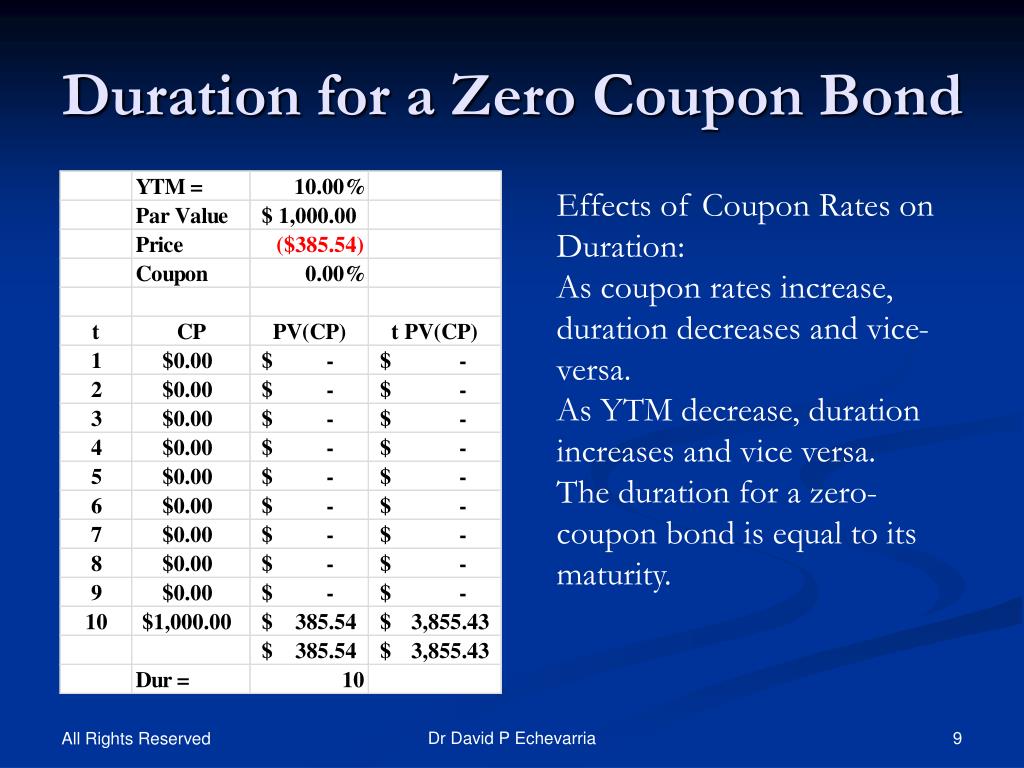

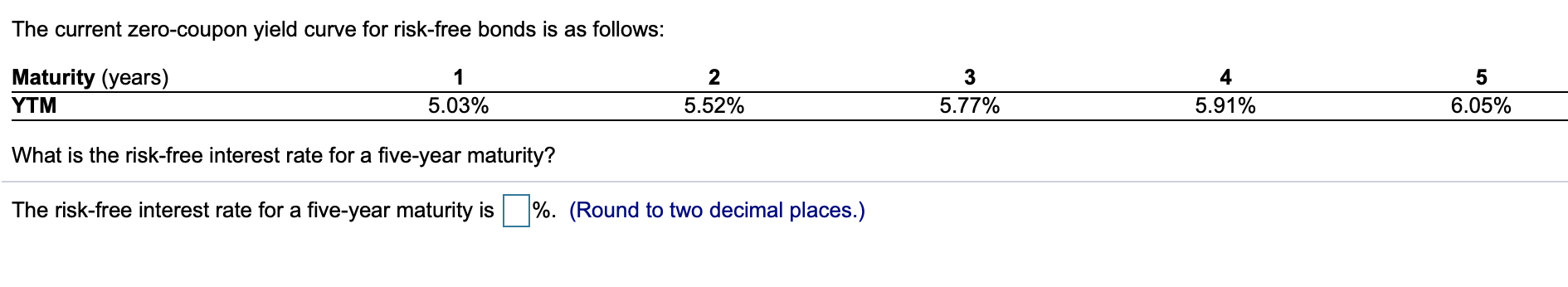

Zero-Coupon Bond: Formula and Excel Calculator - Wall ... To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Zero-Coupon Bond Risks Value and Yield of a Zero-Coupon Bond | Formula & Example The bonds were issued at a yield of 7.18%. The forecasted yield on the bonds as at 31 December 20X3 is 6.8%. Find the value of the zero-coupon bond as at 31 December 2013 and Andrews expected income for the financial year 20X3 from the bonds. Value (31 Dec 20X3) =. $1,000. = $553.17. (1 + 6.8%) 9. Value of Total Holding = 100 × $553.17 ... Zero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between... The yield to maturity (YTM) on a 1-year zero-coupon ... The yield to maturity (YTM) on a 1-year zero-coupon bond is 5.2%, the YTM on a 2-year zero bond is 5.9%, and the YTM on a 3-year zero is 6.2%. The YTM on a 3-year maturity coupon bond with coupon rates of 11.5% (paid annually) is 6%. [Assume a face value of $1,000.] What arbitrage opportunity is available for an investment banking firm?

Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter The formula is mentioned below: Zero-Coupon Bond Yield = F 1/n. PV - 1. Here; F represents the Face or Par Value. PV represents the Present Value. n represents the number of periods. I feel it necessary to mention an example here that will make it easy to understand how to calculate the yield of a zero-coupon bond.

Zero Coupon Bonds - Financial Edge Training What is the present value of a zero coupon bond with a face value of 1000 maturing in 5 years? The current interest rate is 3%. Using the formula mentioned above gives 862.6 as the bond's present value. Calculating yield-to-maturity or expected returns. Yield to maturity (YTM) is the expected return on a bond if it is held until maturity.

FIN: Ch. 6 (Test 2) Flashcards | Quizlet A ten-year, zero-coupon bond with a yield to maturity of 4% has a face value of $1000 . An investor purchases the bond when it is initially traded, and then sells it four years later. What is the rate of return of this investment, assuming the yield to maturity does not change? A) 3.20% B) 2.40% C) 4.00% D) 2.00%

Zero Coupon Bond Value Calculator: Calculate Price, Yield to ... Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months.

How to Calculate a Zero Coupon Bond Price | Double Entry ... The zero coupon bond price or value is the present value of all future cash flows expected from the bond. As the bond has no interest payments, the only cash flow is the face value of the bond received at the maturity date. Zero Coupon Bond Pricing Example. Suppose for example, the business issued 3 year, zero coupon bonds with a face value of ...

A zero coupon bond has a yield to maturity of 12 and a par ... Price of Zero Coupon Bond = F/ (1 + r)t Where, F = Face / Par Value of Bond = $1,000 r = rate of interest = 11% t = number of years = 27 years Price of Bond = $1,000/ ( 1 + 0.11)27 Price of Bond = $59.74 Therefore, The bond should sell for a price of $59.74 today. Thus, Ans:- A. $59.74 104.

CALCULATION OF YTM OF ZERO COUPON BOND USING EXCEL | Dr ... In this lecture I am explaining how to #TYM#YieldToMaturity#HOW_TO_CALCULATE_YIELD_ON_ZERO_COUPON_BOND #YTM_IN_EXCEL calculate the yield on zero COUPON bond ...

Post a Comment for "39 ytm zero coupon bond"