42 zero coupon bonds definition

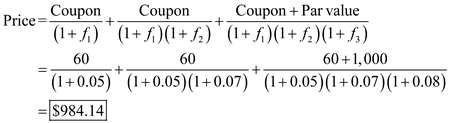

The Pros and Cons of Zero-Coupon Bonds Zero-coupon bonds are a type of bond that does not pay any regular interest payments to the investor. Instead, you purchase the bond for a discount and then when it matures, you can get back the face value of the bond. This is a long-term type of investment that can provide nice yields. Zero-coupon bond financial definition of Zero-coupon bond A bond that provides no periodic interest payments to its owner. A zero-coupon bond is issued at a fraction of its par value (perhaps at $3 to $5 for each $100 of face value for a long-term bond) and increases gradually in value as it approaches maturity. Thus, an investor's income from a zero-coupon bond comes solely from appreciation in value.

Zero Coupon Bonds financial definition of Zero Coupon Bonds A bond that provides no periodic interest payments to its owner. A zero-coupon bond is issued at a fraction of its par value (perhaps at $3 to $5 for each $100 of face value for a long-term bond) and increases gradually in value as it approaches maturity. Thus, an investor's income from a zero-coupon bond comes solely from appreciation in value.

Zero coupon bonds definition

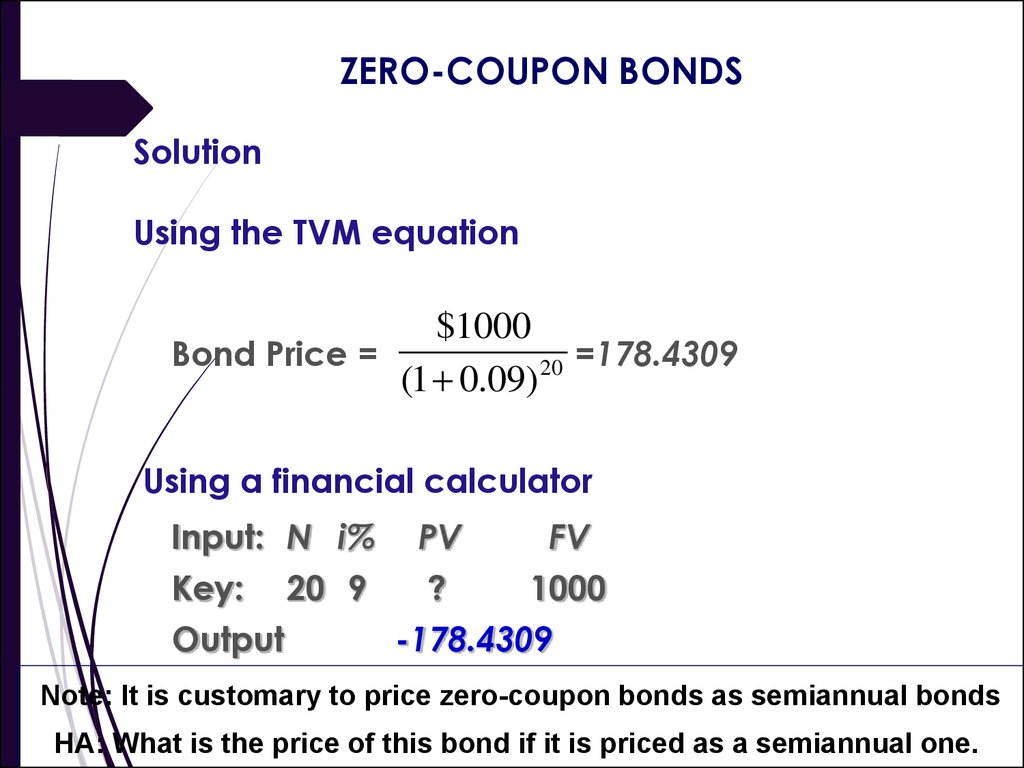

What Is a Zero-Coupon Bond? Definition, Advantages, Risks A zero-coupon bond doesn't pay periodic interest, but instead sells at a deep discount, paying its full face value at maturity. Zeros-coupon bonds are ideal for long-term, targeted financial needs ... Zero Coupon Bond - Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds. Understanding Zero-Coupon Bonds As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value.

Zero coupon bonds definition. Zero-Coupon Bond - TheStreet Zero-coupon bonds don't make interest payments. Instead, they are issued at a discount to face value and mature at face value. For example, a bond with a face value of $1000 might be issued at a... What does zero-coupon bond mean? - definitions.net Definition of zero-coupon bond in the Definitions.net dictionary. Meaning of zero-coupon bond. What does zero-coupon bond mean? Information and translations of zero-coupon bond in the most comprehensive dictionary definitions resource on the web. Zero Coupon Bond | Definition, Formula & Examples - Video ... A zero-coupon bond, which is also referred to as "an accrual bond", is a debt security that does not provide investors with periodic payments or periodic interests. Instead, this type of financial... What is a Zero-Coupon Bond? Definition and Meaning ... Definition and Meaning. A zero-coupon bond, also known as a discount bond, is a type of bond that is purchased at a lower price than its face value. The face value is repaid when the bond reaches maturity. Bonds are kinds of debts or IOUs that corporations and governments sell and investors buy. A zero-coupon bond has no periodic interest ...

What is a Zero Coupon Bond? - Definition | Meaning | Example A Zero coupon bond is a bond that sells without a stated rate of interest. This way the company or government doesn't have to worry about changing interest rates. These bonds are sold at a discount don't pay a standard monthly interest percentage like normal bonds do. Instead, investors receive the gain of the appreciated bond at maturity. Zero Coupon Bond Definition and Example | Investing Answers A zero coupon bond is a bond that makes no periodic interest payments and therefore is sold at a deep discount from its face value. The buyer of the bond receives a return by the gradual appreciation of the security, which is redeemed at face value on a specified maturity date. Zero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between... Zero coupon bond definition - AccountingTools An example of a zero coupon bond is a U.S. savings bond. Disadvantages of Zero Coupon Bonds. Because payments are delayed to maturity, there is a greater chance of fluctuations in the price of a zero coupon bond over its lifespan that reflect changes in interest rates. This presents a higher risk to investors of not gaining expected returns.

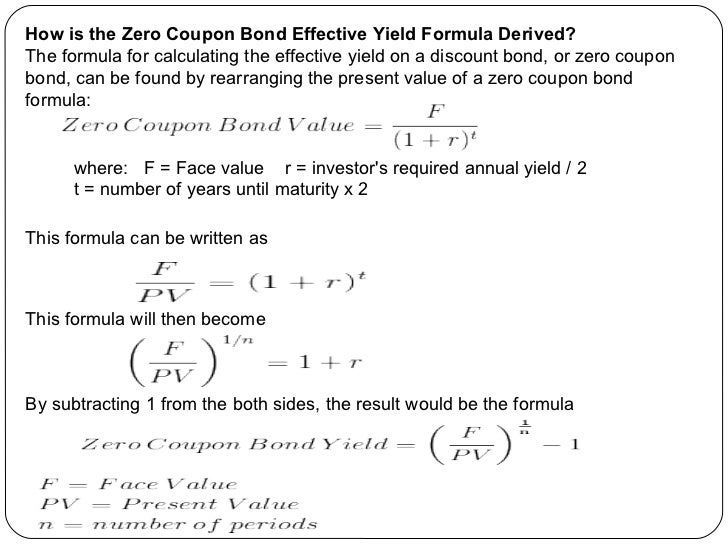

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other words, its annual implied interest payment is included in its face value which is paid at the maturity of such bond. Zero Coupon Bond: Definition, Formula & Example - Video ... A zero coupon bond is a type of bond that doesn't make a periodic interest payment. In bond investing, the term 'coupon' refers to the interest rate repaid periodically to the bondholder. When Tom... Zero-Coupon Bonds - Accounting Hub A zero-coupon bond is a debt instrument and it pays no periodic interest. This bond is traded at a deep discount to its face value. US treasury bills are a prime example of zero-coupon bonds. These bonds are also called discount bonds. These bonds can be issued with zero interest from the beginning. Zero Coupon Bonds - definition of Zero Coupon Bonds by The ... zero-coupon bond - a bond that is issued at a deep discount from its value at maturity and pays no interest during the life of the bond; the commonest form of zero-coupon security zero coupon bond

Advantages and Risks of Zero Coupon Treasury Bonds Zero-coupon U.S. Treasury bonds are also known as Treasury zeros, and they often rise dramatically in price when stock prices fall. Zero-coupon U.S. Treasury bonds can move up significantly when...

Zero coupon Definition & Meaning - Merriam-Webster Definition of zero coupon : of, relating to, or being an investment security that is sold at a deep discount, is redeemable at face value on maturity, and that pays no periodic interest zero coupon municipal bonds Examples of zero coupon in a Sentence

Zero-coupon bond | definition of zero-coupon bond by ... zero [ze´ro] 1. the absence of all quantity or magnitude; naught. 2. the point on a thermometer scale at which the graduations begin. The zero of the Celsius (centigrade) scale is the ice point; on the Fahrenheit scale it is 32 degrees below the ice point. absolute zero the lowest possible temperature, designated 0 on the Kelvin or Rankine scale; the ...

Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. That definition assumes a positive time value of money.It does not make periodic interest payments or have so-called coupons, hence the term zero coupon bond.When the bond reaches maturity, its investor receives its par (or face) value.

Zero Coupon Bond Funds: What Are They? - The Balance A zero coupon bond fund is a fund that contains zero coupon bonds. Zero coupon bonds don't pay interest, but they are purchased at a steep discount and the buyer receives the full par value upon maturity. Zero coupon bond funds can be structured as a mutual fund or an ETF.

zero coupon bonds definition and meaning | AccountingCoach zero coupon bonds definition. A bond without a stated interest rate. Because no interest is paid, the bond will sell for a discount from its maturity value. Rather than receiving interest, an investor's compensation will be the difference between the discounted price at which the bond was purchased and the price the investor receives when ...

Zero-Coupon Bonds: Definition, Formula, Example ... A zero-coupon bond can be described as a financial instrument that does not render interest. They normally trade at high discounts, and offer full face par value, at the time of maturity. The spread between the purchase price of the bond and the price that the bondholder receives at maturity is described as the profit of the bondholder.

14.3 Accounting for Zero-Coupon Bonds - Financial Accounting A zero-coupon bond is one that is popular because of its ease. The face value of a zero-coupon bond is paid to the investor after a specified period of time but no other cash payment is made. There is no stated cash interest. Money is received when the bond is issued and money is paid at the end of the term but no other payments are ever made.

Zero coupon bond - definition of zero coupon bond by The ... zero coupon bond - a bond that is issued at a deep discount from its value at maturity and pays no interest during the life of the bond; the commonest form of zero-coupon security zero-coupon bond

united states - Can zero-coupon bonds go down in price? - Personal Finance & Money Stack Exchange

Zero-Coupon Bond: Definition, Formula, Example etc ... Hence, Zero Coupon bond is the bond which has a zero interest and the investor purchase it with lower price than its face value, and reimbursed full face value amount at the time of maturity. There are different types of Zero Coupon bond. From the start, some company is issued their bond as zero-coupon instruments.

Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds. Understanding Zero-Coupon Bonds As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value.

Zero Coupon Bond - Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due.

What Is a Zero-Coupon Bond? Definition, Advantages, Risks A zero-coupon bond doesn't pay periodic interest, but instead sells at a deep discount, paying its full face value at maturity. Zeros-coupon bonds are ideal for long-term, targeted financial needs ...

Post a Comment for "42 zero coupon bonds definition"