38 a 10 year bond with a 9 annual coupon

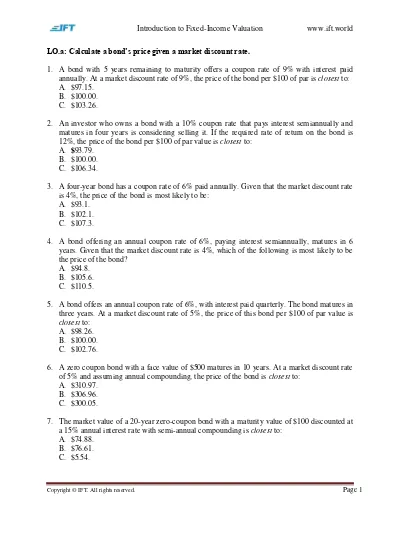

› news › adb-sells-4-billion-dual-tranchADB Sells $4 Billion Dual Tranche 2- and 10-Year Global ... Sep 22, 2022 · The 10-year bond, with a coupon rate of 3.875% per annum payable semi-annually and a maturity date of 9 June 2028, was priced at 99.910% to yield 31.5 basis points over the 2.75% US Treasury notes due 15 August 2032. Solved A 10-year bond with a 9% annual coupon has a yield to | Chegg.com A 10-year bond with a 9% annual coupon has a yield to maturity of 8% which statement about this bond is correct? O a. The bond is selling at a premium to its par value. O b. The bond is selling at a discount to its par value. O c. The bond is selling below its par value O d. The bond is price to sell at its par value. Save & Continue

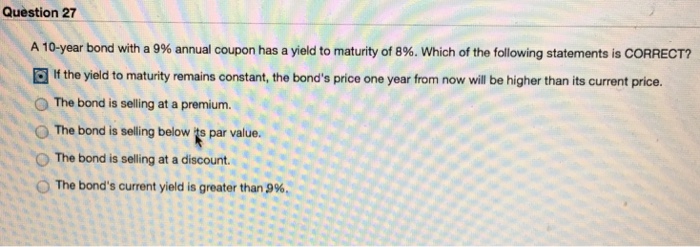

Solved A 10-year bond with a 9% annual coupon has a yield to - Chegg Question: A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. the bond is selling below its par value b. the bond is selling at a discount c. the bond will earn a rate of return greater than 8% d. the bond is selling at a premium to par value This problem has been solved!

A 10 year bond with a 9 annual coupon

Answered: A 10-year bond with a 9% annual coupon… | bartleby Transcribed Image Text: A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? * If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. The bond is selling below its par value. The bond's current yield is greater than 9%. chapter5practicetest.docx - A 10-year bond with a 9% annual... chapter5practicetest.docx - A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? Select chapter5practicetest.docx - A 10-year bond with a 9% annual... School Texas State University Course Title FIN 3313 Uploaded By tynupe Pages 6 Ratings 71% (7) en.wikipedia.org › wiki › Elizabeth_IIElizabeth II - Wikipedia Her fourth child, Prince Edward, was born on 10 March 1964. In addition to performing traditional ceremonies, Elizabeth also instituted new practices. Her first royal walkabout, meeting ordinary members of the public, took place during a tour of Australia and New Zealand in 1970. Acceleration of decolonisation

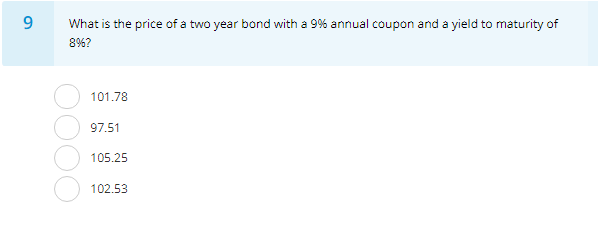

A 10 year bond with a 9 annual coupon. 📈What is the price of a two year bond with a 9% annual coupon and a ... The bond price 101.78. What is the price of a bond? A bond price is the present value of its future cash flows discounted at the yield to maturity which is the appropriate discount rate.. Specifically, the bond price is the present value of annual coupons for 2 two years and the face value discounted at the 8% yield to maturity.. We can determine the bond price using the present value formula ... A 10-year corporate bond has an annual coupon of 9%. The bond is ... A 10-year corporate bond has an annual coupon of 9%. The bond is currently selling at par ($1,000). Which of the following statements is CORRECT? a. The bond's expected capital gains yield is zero. b. The bond's yield to maturity is above 9%. c. The bond's current yield is above 9%. d. › 2016 › 10-year-treasury-bond10 Year Treasury Rate - 54 Year Historical Chart | MacroTrends 10 Year Treasury Rate - 54 Year Historical Chart. Interactive chart showing the daily 10 year treasury yield back to 1962. The 10 year treasury is the benchmark used to decide mortgage rates across the U.S. and is the most liquid and widely traded bond in the world. The current 10 year treasury yield as of October 06, 2022 is 3.83%. Solved A 10-year bond with a 9% annual coupon has a yield to - Chegg A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. b. If the yield to maturity remains constant, the bond's price one year from now will be higher than its

A 10-year bond with a 9% annual coupon has a yield to maturity… I have a question: A 20-year, $1,000 par value bond has a 9% annual coupon. The bond currently sells for $925. If the yield to maturity remains at its current rate, what will the price be 5 years from … read more Answered: A 10-year bond with a 9% annual coupon… | bartleby A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? Group of answer choices If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. The bond is selling below its par value. The bond is selling at a discount. Coupon Payment Calculator Assuming you purchase a 30-year bond at a face value of $1,000 with a fixed coupon rate of 10%, the bond issuer will pay you: $1,000 * 10% = $100 as a coupon payment. If the bond agreement is semiannual, you'll receive two payments of $50 on the bond agreed payment dates.. You can quickly calculate the coupon payment for each payment period using the coupon payment formula: A 10 year bond with a 9 annual coupon has a yield to A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. If the yield to maturity remains constant, the bond's price one year from now will be higher than its current price. b. The bond is selling below its par value.c. The bond is selling at a discount. d.

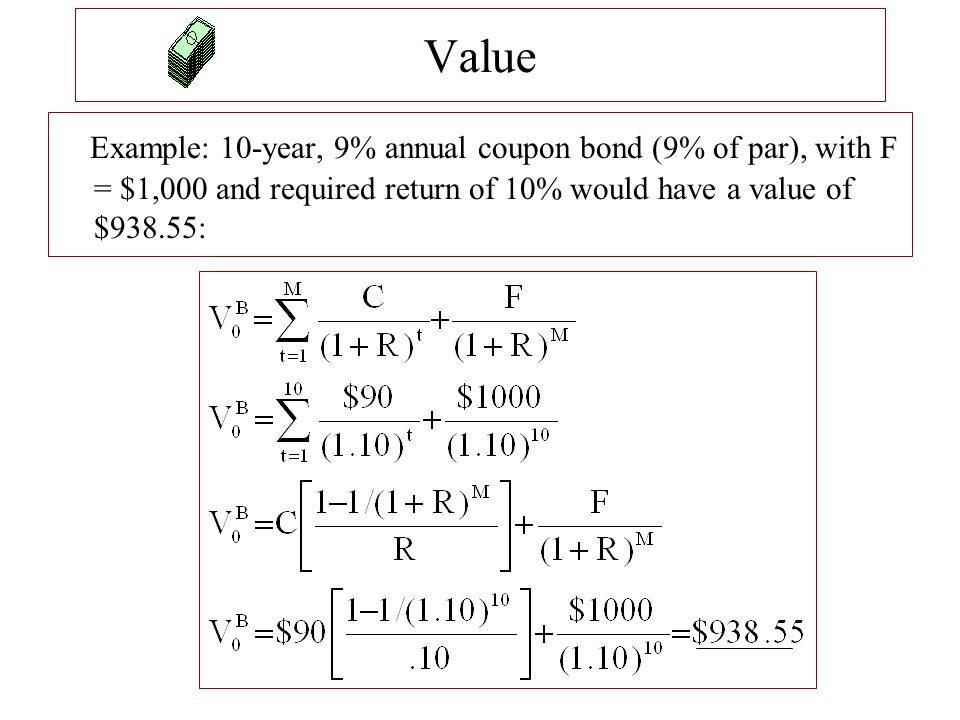

3. A 10-year corporate bond has an annual coupon of 9%. The… - JustAnswer I have a question: A 20-year, $1,000 par value bond has a 9% annual coupon. The bond currently sells for $925. If the yield to maturity remains at its current rate, what will the price be 5 years from … read more Bond Price Calculator | Formula | Chart The n for Bond A is 10 years. Determine the yield to maturity (YTM). The YTM is the annual rate of return that the bond investor will get if they hold the bond from now to when it matures. In this example, YTM = 8%. Calculate the bond price Question 12 a 10 year bond with a 9 annual coupon has Question 12 A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? Selected Answer: If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. slickdeals.net › f › 15758386-us-treasury-series-iUS Treasury Series I Savings Bonds Inflation Rate Earnings ... Apr 28, 2022 · The interest is compounded semiannually. Every six months from the bond's issue date, interest the bond earned in the six previous months is added to the bond's principal value, creating a new principal value. Interest is then earned on the new principal. The composite rate for I bonds issued from May 2022 through October 2022 is 9.62 percent ...

Answered: A 10-year corporate bond has an annual… | bartleby Solution for A 10-year corporate bond has an annual coupon payment of 5%. The bond is currently selling at par ($1,100). Which of the following statement is…

home.treasury.gov › policy-issues › financing-theInterest Rate Statistics | U.S. Department of the Treasury Sep 30, 2010 · Treasury ceased publication of the 30-year constant maturity series on February 18, 2002 and resumed that series on February 9, 2006. To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate ...

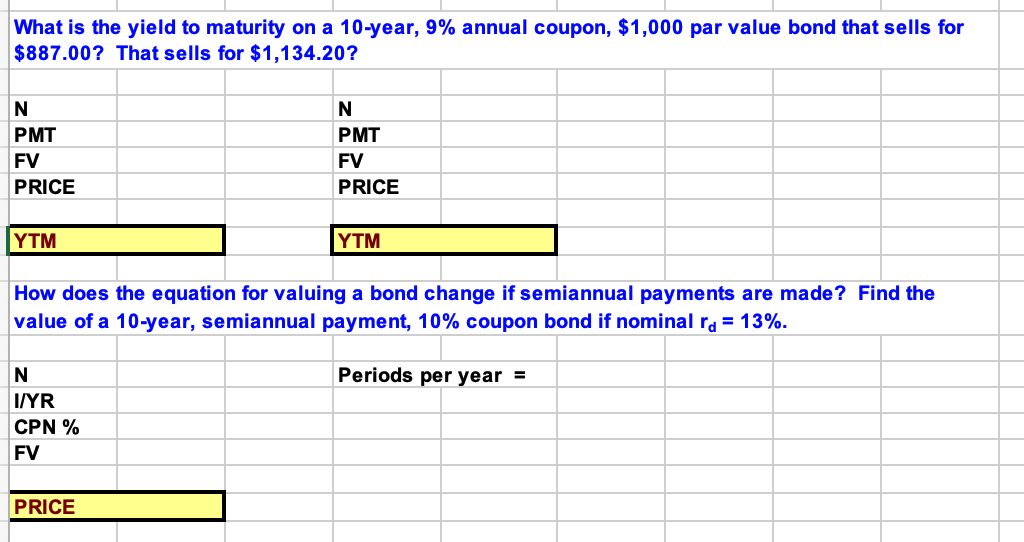

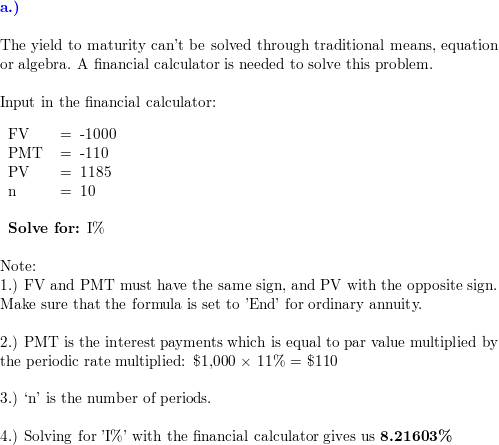

Answered: Assume a 10-year, $1,000 par value bond… | bartleby Q: What is the yield to maturity on a 10-year, 9 percent annual coupon, $1,000 par value bond that… A: Yield to maturity(YTM) is the rate of return on bond that is obtained if bond is held till maturity.…

A 10-year bond with a 9% annual coupon has a yield to maturity of 8% ... A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? Group of answer choices If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. The bond is selling below its par value. The bond is selling at a discount.

a-10-year-bond-with-a-9-percent-annual-coupon-has-a-yield A 10-year bond with a 9 percent annual coupon has a yield to maturity of 8 percent. Which of the following statements is most correct? a. The bond is selling at a discount. b. The bond's current yield is greater than 9 percent. c. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. d.

A 10 year corporate bond has an annual coupon of 9 A 10-year corporate bond has an annual coupon of 9%. The bond is currently selling at par ($1,000). Which of the following statements is INCORRECT? a. The bond's expected capital gains yield is positive. b. The bond's yield to maturity is 9%. c. The bond's current yield is 9%. d. The bond's current yield exceeds its capital gains yield. ANS: A a.

What is the yield to maturity for a 3 year bond with a 10% annual ... The yield of maturity will be 10% itself , Option C is the right answer. The missing option are What is the yield to maturity for a 3 year bond with a 10% annual coupon if the bond is trading at par? A) 11.00% B) 9.00% C) 10.00% D) 9.75% What is the meaning of Trading at Par ? At par means the bond or stock is trading at its face value ,

How to Calculate the Price of Coupon Bond? - WallStreetMojo Therefore, calculation of the Coupon Bond will be as follows, So it will be - = $838.79 Therefore, each bond will be priced at $838.79 and said to be traded at a discount ( bond price lower than par value) because the coupon rate is lower than the YTM. XYZ Ltd will be able to raise $4,193,950 (= 5,000 * $838.79). Example #2

A 10-year bond paying 8% annual coupons pays $1000 at maturity ... - Quora The coupon is 6% of 20,000 or 1200 per year. The interest rate used in present value calculation is the required rate of return of 8%. Using sum of geometric series The present value of the bond is 20,000 discounted at 8% for 5 years Final Answer: Fair Value = Continue Reading Scott Korba

en.wikipedia.org › wiki › Bond_(finance)Bond (finance) - Wikipedia In effect, a $100,000, 5-year serial bond would mature in a $20,000 annuity over a 5-year interval. The conditions applying to the bond. Fixed rate bonds have interest payments ("coupon"), usually semi-annual, that remains constant throughout the life of the bond.

A 10 year bond with a 9 annual coupon has a yield to - Course Hero A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? * 1/1 a. If the yield to maturity remains constant, the bond's price one year from now will be higher than its current price. b. The bond is selling below its par value. c. The bond is selling at a discount. d.

What is the price of a 10-year, 10% coupon bond with a $1,000 face ... What is the price of a 10-year, 10% coupon bond with a $1,000 face value if investors require a 12% return? Assume annual coupon payments. $565.00 $322.00 $604.50 $887.00 Show Result. Related MCQs? A curve on a graph with the rate of return on the vertical axis and time on the horizontal axis depicts ...

Answered: A 10-year, 12 percent semiannual coupon… | bartleby A 10-year, 12 percent semiannual coupon bond, with a par value of $1,000 sells for $1,100. What is the bond s yield to maturity?

› investing › bondTMUBMUSD10Y | U.S. 10 Year Treasury Note Overview | MarketWatch 2 days ago · TMUBMUSD10Y | A complete U.S. 10 Year Treasury Note bond overview by MarketWatch. View the latest bond prices, bond market news and bond rates.

What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

A 10-year corporate bond has an annual coupon of 9%. The bond… A 10-year corporate bond has an annual coupon of 9%. The bond is currently selling at par ($1,000). Which of the following statements is NOT CORRECT? Answer a. The bond's expected capital gains yield is positive. b. The bond's yield to maturity is 9%. c. The bond's current yield is 9%. d. If the bond's yield to maturity remains constant ...

A 10-year bond with a 9% annual coupon has a yield to...ask 5 - Quesba A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following... A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. the bond is selling below its par value. b. the bond is selling at a discount. c. the bond will earn a rate of return greater than 8%.

en.wikipedia.org › wiki › Elizabeth_IIElizabeth II - Wikipedia Her fourth child, Prince Edward, was born on 10 March 1964. In addition to performing traditional ceremonies, Elizabeth also instituted new practices. Her first royal walkabout, meeting ordinary members of the public, took place during a tour of Australia and New Zealand in 1970. Acceleration of decolonisation

chapter5practicetest.docx - A 10-year bond with a 9% annual... chapter5practicetest.docx - A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? Select chapter5practicetest.docx - A 10-year bond with a 9% annual... School Texas State University Course Title FIN 3313 Uploaded By tynupe Pages 6 Ratings 71% (7)

Answered: A 10-year bond with a 9% annual coupon… | bartleby Transcribed Image Text: A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? * If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. The bond is selling below its par value. The bond's current yield is greater than 9%.

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

![Solved] A 20-year, $1,000 par value bond has a 9% semi-annual ...](https://www.cliffsnotes.com/tutors-problems/assets/img/attachments/20153955.jpg)

Post a Comment for "38 a 10 year bond with a 9 annual coupon"