41 zero coupon convertible bond

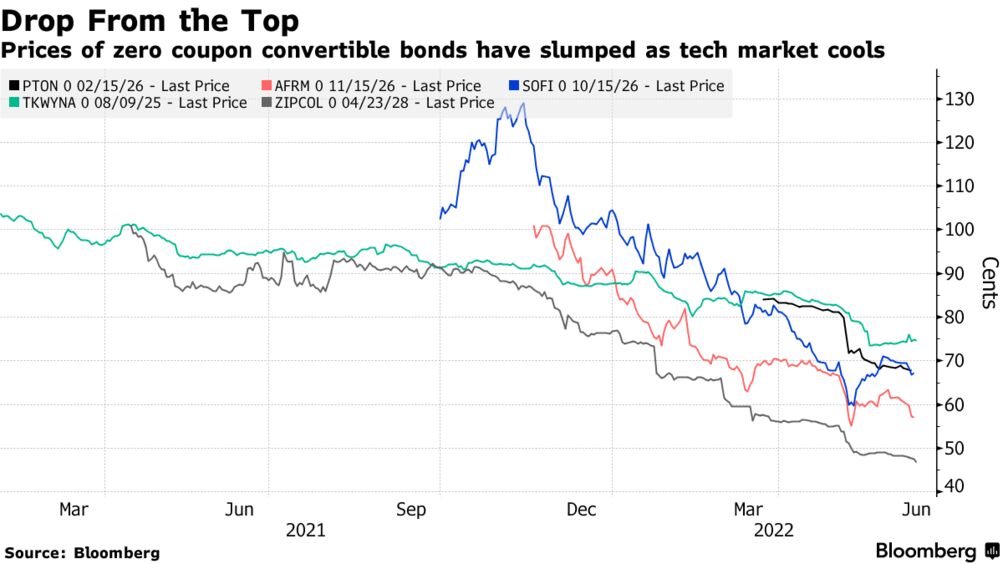

Zero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between... Record Run for Zero-Interest Convertible Bonds Hits a Wall Investors gobbled up convertible bonds with zero coupon from companies including Airbnb, SoFi, Snap, Ford, DraftKings, Twitter, Shake Shack, Spotify and Dish Network. They were essentially lending...

Zero-coupon convertible bond - TheFreeDictionary.com Zero-Coupon Convertible Bond 1. A bond that may be converted into common stock in the company issuing it. A zero-coupon convertible bond is sold at a discount from par and matures at par. They tend to be volatile in the secondary market because the convertible option may or may not become worthwhile, depending on how the company is performing.

Zero coupon convertible bond

Zero-Coupon Convertible Zero - Coupon Convertible. A fixed income instrument that is a combination of a zero - coupon bond and a convertible bond. Due to the zero - coupon feature, the bond pays no interest and is issued at a discount to par value, while the convertible feature means that the bond is convertible into common stock of the issuer at a certain conversion ... Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding Zero coupon convertibles do not have a zero cost Zero coupon convertibles do not have a zero cost Published 11 May 2021 Convertible bond issuance is at a record high, with companies 'benefiting' from low interest rates and high equity volatility. A recent $1.44bn convertible bond issue by Twitter, with a zero coupon and conversion premium of 67%, is a good example.

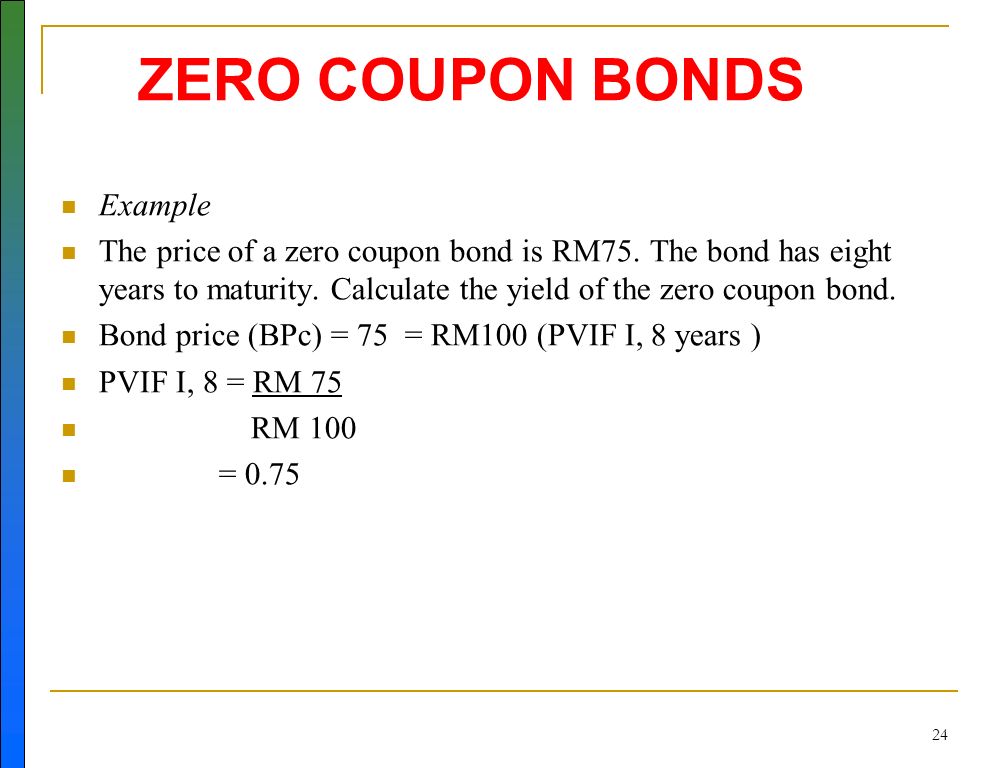

Zero coupon convertible bond. Zero-Coupon Bond: Formula and Calculator - Wall Street Prep To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Interest Rate Risks and "Phantom Income" Taxes The One-Minute Guide to Zero Coupon Bonds | FINRA.org zero-coupon bond on the secondary market will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. What is Zero-Coupon Convertible Bond? Definition, Meaning, Example ... Due to the interest-free feature, this bond does not pay interest and is released at a lower price of par value, while the conversion feature means that the bond can convert into the universal shares of the company released with Certain transformation price. ... Zero-Coupon Convertible Bond. 0 ... Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other words, its annual implied interest payment is included in its face value which is paid at the maturity of such bond.

SGX fully places out zero coupon convertible bonds The Singapore Exchange (SGX) has fully placed out €240 million (S$386 million) of its zero coupon convertible bonds due March 1, 2024, with a "high-quality book of institutional investors ... Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia These bonds are called convertibles. Banks and brokerage firms can also create zero-coupon bonds. These entities take a regular bond and remove the coupon to create a pair of new securities. This... Zero-coupon convertible bond - TheFreeDictionary.com Zero-Coupon Convertible Bond 1. A bond that may be converted into common stock in the company issuing it. A zero-coupon convertible bond is sold at a discount from par and matures at par. They tend to be volatile in the secondary market because the convertible option may or may not become worthwhile, depending on how the company is performing ... Duration and convexity of zero-coupon convertible bonds Figure 1a-d show the above convertible duration, D CB, for four different sets of parameter values.For comparison, we have also shown the duration of the following: 1) a default-free zero-coupon bond with the same maturity; 2) a corporate bond with exactly the same details (face value, maturity, etc.), except that it is non-convertible; and 3) a convertible bond using the Calamos (1988 ...

Zero Coupon Convertible Debenture Law and Legal Definition Zero Coupon Convertible Debenture/security is a zero coupon bond that is convertible into the common stock of the issuing company after the common stock reaches a certain price. A zero-coupon bond (also called a discount bond or deep discount bond) is a bond bought at a price lower than its face value. Zero-Coupon Bonds: Pros and Cons Zero-coupon bonds are commonly issued by governments. In this article, we will have a closer look at the pros and cons of zero-coupon bonds from an investor's point of view: Pros of Zero-Coupon Bonds. There are many zero-coupon bonds that are already in existence. Also, each year, many new zero-coupon bonds are issued. Despite there being so ... Zero-Coupon Bonds and Taxes - Investopedia The difference between a regular bond and a zero-coupon bond is the payment of interest, otherwise known as coupons. A regular bond pays interest to bondholders, while a zero-coupon bond does not... Zero-Coupon Convertible - Investopedia A zero-coupon convertible can also refer to a zero-coupon issued by a municipality that can be converted to an interest-paying bond at a certain time before the maturity date. When a municipal...

Zero Coupon Bonds- Taxability Under Income Tax Act, 1961 - TaxWink Under Income Tax Act, 1961, Income derived from gain on sale of shares, debentures, bonds etc. attracts taxability under the head of "Capital Gains". Such gain is either taxable as short term capital gain or long term capital gain. In this article, we will discuss the concept of "Zero Coupon Bonds" and throw light on taxing aspects of ...

Zero-coupon convertible bond - TheFreeDictionary.com Zero-Coupon Convertible Bond 1. A bond that may be converted into common stock in the company issuing it. A zero-coupon convertible bond is sold at a discount from par and matures at par. They tend to be volatile in the secondary market because the convertible option may or may not become worthwhile, depending on how the company is performing ...

Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due.

Zero coupon convertibles do not have a zero cost Zero coupon convertibles do not have a zero cost Published 11 May 2021 Convertible bond issuance is at a record high, with companies 'benefiting' from low interest rates and high equity volatility. A recent $1.44bn convertible bond issue by Twitter, with a zero coupon and conversion premium of 67%, is a good example.

Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding

Zero-Coupon Convertible Zero - Coupon Convertible. A fixed income instrument that is a combination of a zero - coupon bond and a convertible bond. Due to the zero - coupon feature, the bond pays no interest and is issued at a discount to par value, while the convertible feature means that the bond is convertible into common stock of the issuer at a certain conversion ...

![PDF] Duration and convexity of zero-coupon convertible bonds ...](https://d3i71xaburhd42.cloudfront.net/39b5487ce4f8becdfb0faf5ae6e30fd10537436c/13-Figure5-1.png)

/ConvertibleBondsPrice2-2285ff1211c545be919565380a232a02.png)

![PDF] Duration and convexity of zero-coupon convertible bonds ...](https://d3i71xaburhd42.cloudfront.net/39b5487ce4f8becdfb0faf5ae6e30fd10537436c/7-Figure1-1.png)

![PDF] Duration and convexity of zero-coupon convertible bonds ...](https://d3i71xaburhd42.cloudfront.net/39b5487ce4f8becdfb0faf5ae6e30fd10537436c/10-Figure3-1.png)

Post a Comment for "41 zero coupon convertible bond"