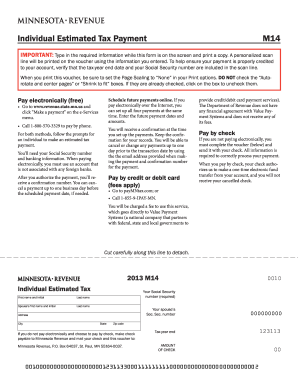

42 payment coupon for irs

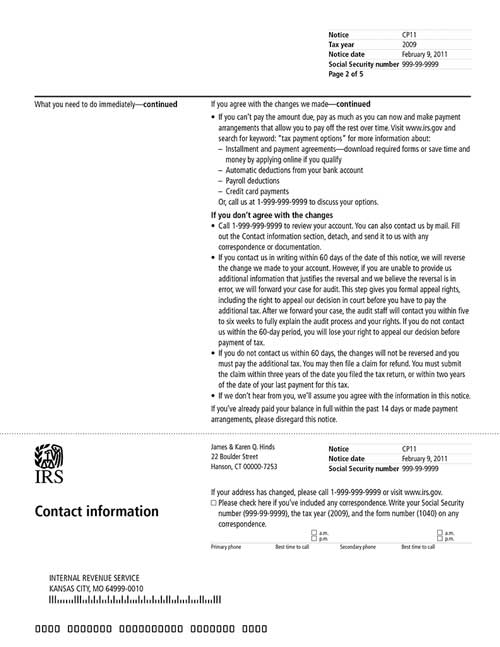

› newsroom › irs-operations-during-covidIRS Operations During COVID-19: Mission-critical functions ... Oct 13, 2022 · Taxpayers can ask for a payment plan with the IRS by filing Form 9465. Taxpayers can download this form from IRS.gov and mail it along with a tax return, bill or notice. Some taxpayers can use the online payment agreement application to set up a monthly payment agreement without having to speak to the IRS by phone. › publications › p463Publication 463 (2021), Travel, Gift, and Car Expenses ... Go to IRS.gov/OrderForms to order current forms, instructions, and publications; call 800-829-3676 to order prior-year forms and instructions. The IRS will process your order for forms and publications as soon as possible. Don’t resubmit requests you’ve already sent us. You can get forms and publications faster online.

› money › taxesIRS “Get My Payment” Tool Lets You Track Your Stimulus Check Mar 29, 2021 · Payment Status Not Available. If the tool returns a “Payment Status Not Available” message, either the IRS hasn’t processed your payment, it doesn’t have enough information to issue a payment, or you aren’t eligible for a payment. Keep checking to see if your status changes. Get My Payment is updated once daily, usually overnight.

Payment coupon for irs

turbotax.intuit.com › tax-tips › tax-paymentsWhat Is the Minimum Monthly Payment for an IRS Installment ... Oct 16, 2021 · Fees for IRS installment plans. If you can pay off your balance within 120 days, it won't cost you anything to set up an installment plan. If you cannot pay off your balance within 120 days, setting up a direct debit payment plan online will cost $31, or $107 if set up by phone, mail, or in-person. › instructions › iw2w3General Instructions for Forms W-2 and W-3 (2022 ... - IRS ... Extensions of time to file. Extensions of time to file Form W-2 with the SSA are not automatic. You may request one 30-day extension to file Form W-2 by submitting a complete application on Form 8809, Application for Extension of Time To File Information Returns, indicating that at least one of the criteria on the form and instructions for granting an extension applies, and signing under ... Electronic Federal Tax Payment System (EFTPS) - IRS tax forms Publication 3381(Rev.11-1999) Catalog Number 27462M IRS. Publication 3381 Page 2 of 3 When you enroll in EFTPS you can select a payment method. There are two primary payment methods. You can select either or both. EFTPS Direct - This method instructs EFTPS to move the funds from your account to the Treasury’s account on the date you designate. Select …

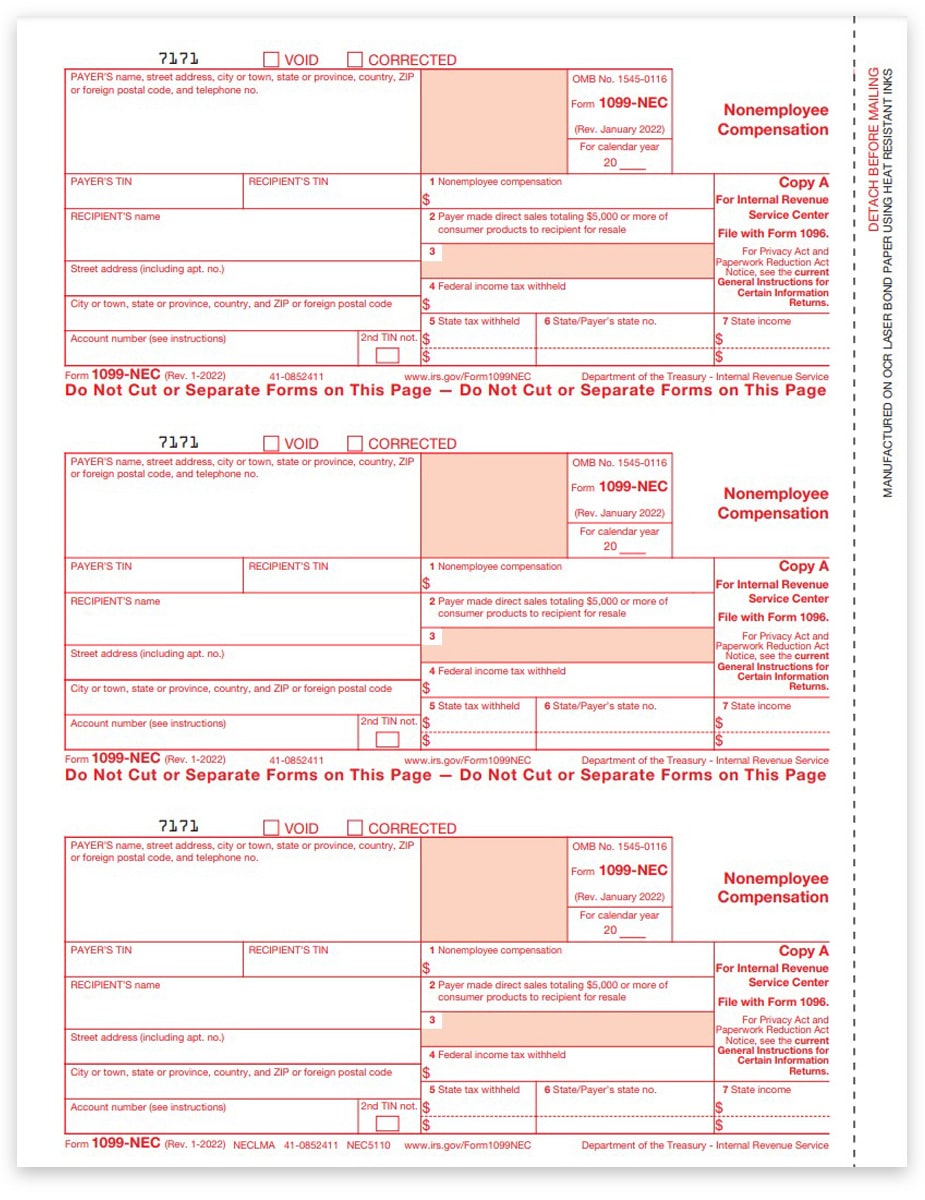

Payment coupon for irs. › publications › p519Publication 519 (2021), U.S. Tax Guide for Aliens | Internal ... As a result, a taxpayer may be treated as having received a dividend equivalent payment even if the taxpayer makes a net payment or no amount is paid because the net amount is zero. In 2021, an NPC or ELI will generally be a specified NPC or specified ELI, respectively, if the contract is a delta one transaction. 2022 Form 1040-ES - IRS tax forms 1st payment..... April 18, 2022 2nd payment..... June 15, 2022 3rd payment..... Sept. 15, 2022 4th payment..... Jan. 17, 2023* * You don’t have to make the payment due January 17, 2023, if you file your 2022 tax return by January 31, 2023, and pay the entire balance due with your return. If you mail your payment and it is postmarked by the › instructions › i1099intInstructions for Forms 1099-INT and 1099-OID (01/2022) Exempt recipients. You are not required to file Form 1099-INT for payments made to certain payees including, but not limited to, a corporation, a tax-exempt organization, any individual retirement arrangement (IRA), Archer medical savings account (MSA), Medicare Advantage MSA, health savings account (HSA), a U.S. agency, a state, the District of Columbia, a U.S. possession, a registered ... Electronic Federal Tax Payment System (EFTPS) - IRS tax forms Publication 3381(Rev.11-1999) Catalog Number 27462M IRS. Publication 3381 Page 2 of 3 When you enroll in EFTPS you can select a payment method. There are two primary payment methods. You can select either or both. EFTPS Direct - This method instructs EFTPS to move the funds from your account to the Treasury’s account on the date you designate. Select …

› instructions › iw2w3General Instructions for Forms W-2 and W-3 (2022 ... - IRS ... Extensions of time to file. Extensions of time to file Form W-2 with the SSA are not automatic. You may request one 30-day extension to file Form W-2 by submitting a complete application on Form 8809, Application for Extension of Time To File Information Returns, indicating that at least one of the criteria on the form and instructions for granting an extension applies, and signing under ... turbotax.intuit.com › tax-tips › tax-paymentsWhat Is the Minimum Monthly Payment for an IRS Installment ... Oct 16, 2021 · Fees for IRS installment plans. If you can pay off your balance within 120 days, it won't cost you anything to set up an installment plan. If you cannot pay off your balance within 120 days, setting up a direct debit payment plan online will cost $31, or $107 if set up by phone, mail, or in-person.

/1099-A-0151e1f82f624920b802b26d693d47f6.jpg)

:max_bytes(150000):strip_icc()/1040-V-df038816cc244b248641f447493a030d.jpg)

/1040-V-df038816cc244b248641f447493a030d.jpg)

/FUNERAL_GIFT_CHECK-56a2756c5f9b58b7d0cac5f3.jpg)

/Form1099-INT2022-5e04b7fa54e54d2789d24757e86b1bff.jpg)

Post a Comment for "42 payment coupon for irs"