38 advantage of zero coupon bonds

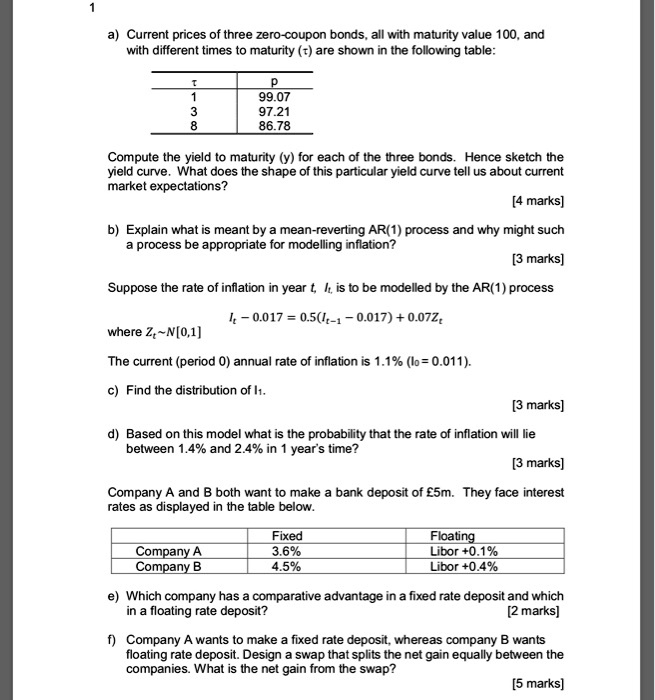

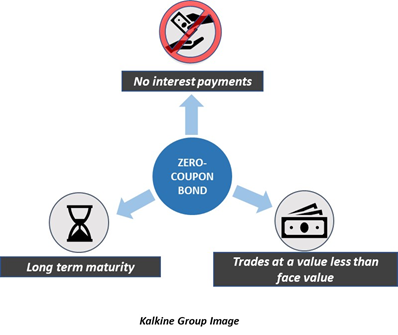

Invest in Zero Coupon Bond at Yubi | Learn All About It The imputed interest added to the purchase price gives yield to maturity of the zero coupon bond, which the investor receives automatically in the future as a phantom income. The long time horizon of zero coupon bonds is a major advantage for investors. With long-term maturity dates, bond buyers do not need to worry about the short term. U.S. News | Latest National News, Videos & Photos - ABC News ... Nov 08, 2022 · Get the latest breaking news across the U.S. on ABCNews.com

Microsoft takes the gloves off as it battles Sony for its ... Oct 12, 2022 · Microsoft pleaded for its deal on the day of the Phase 2 decision last month, but now the gloves are well and truly off. Microsoft describes the CMA’s concerns as “misplaced” and says that ...

Advantage of zero coupon bonds

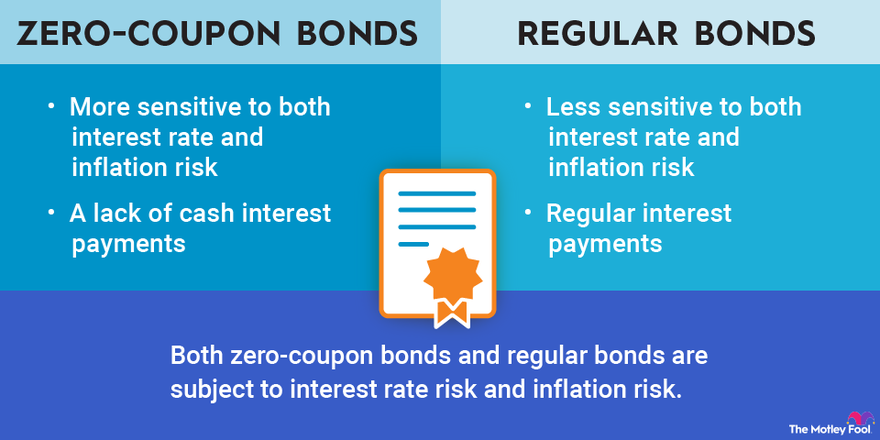

Success Essays - Assisting students with assignments online We care about the privacy of our clients and will never share your personal information with any third parties or persons. What is a Zero-Coupon Bond? Definition, Features, Advantages ... Advantages of Zero-Coupon Bond A zero-coupon bond is a secured form of investment when done for the long term. The various benefits it can provide are mentioned below: Predictable Returns: The return on a deeply discounted bond after maturity, is pre-known to the investor in the form of par value or face value. Coupon Bond Vs. Zero Coupon Bond: What's the Difference? - Investopedia Zero-coupon bonds are more volatile than coupon bonds, so speculators can use them to profit more from anticipated short-term price movements. Zero-coupon bonds can help investors to...

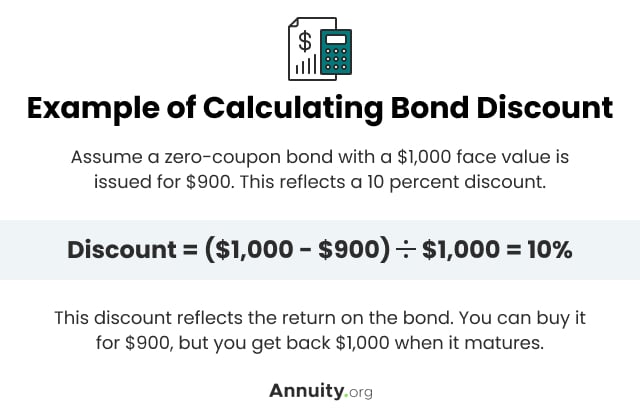

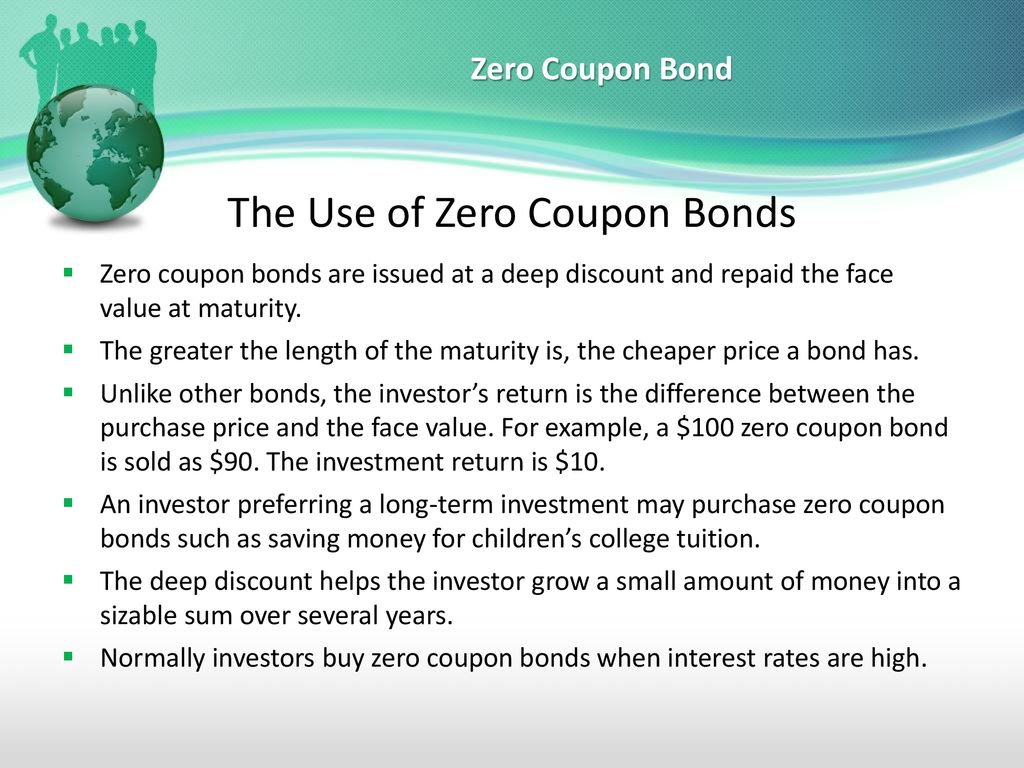

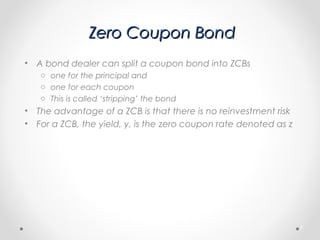

Advantage of zero coupon bonds. What Is a Zero-Coupon Bond? Definition, Advantages, Risks Advantages of zero-coupon bonds They often have higher interest rates than other bonds Since zero-coupon bonds do not provide regular interest payments, their issuers must find a... U.S. appeals court says CFPB funding is unconstitutional ... Oct 20, 2022 · That means the impact could spread far beyond the agency’s payday lending rule. "The holding will call into question many other regulations that protect consumers with respect to credit cards, bank accounts, mortgage loans, debt collection, credit reports, and identity theft," tweeted Chris Peterson, a former enforcement attorney at the CFPB who is now a law professor at the University of Utah. Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww Advantages of Zero-Coupon Bonds. It is important to understand the advantages of a Zero Coupon bond before opting for this investment. The advantages are mentioned below: No reinvestment risk: Other coupon bonds don't allow investors to a bond's cash flow at the same rate as the investment's required rate of returns. But the Zero Coupon ... Zero-Coupon Bonds | AnnuityAdvantage For example, a zero-coupon bond with a face value of $5,000, a maturity date of 20 years, and a 5% interest rate might cost only a few hundred dollars. When the bond matures, the bondholder receives the face value of the bond ($5,000 in this case), barring default. The value of zero-coupon bonds is subject to market fluctuations.

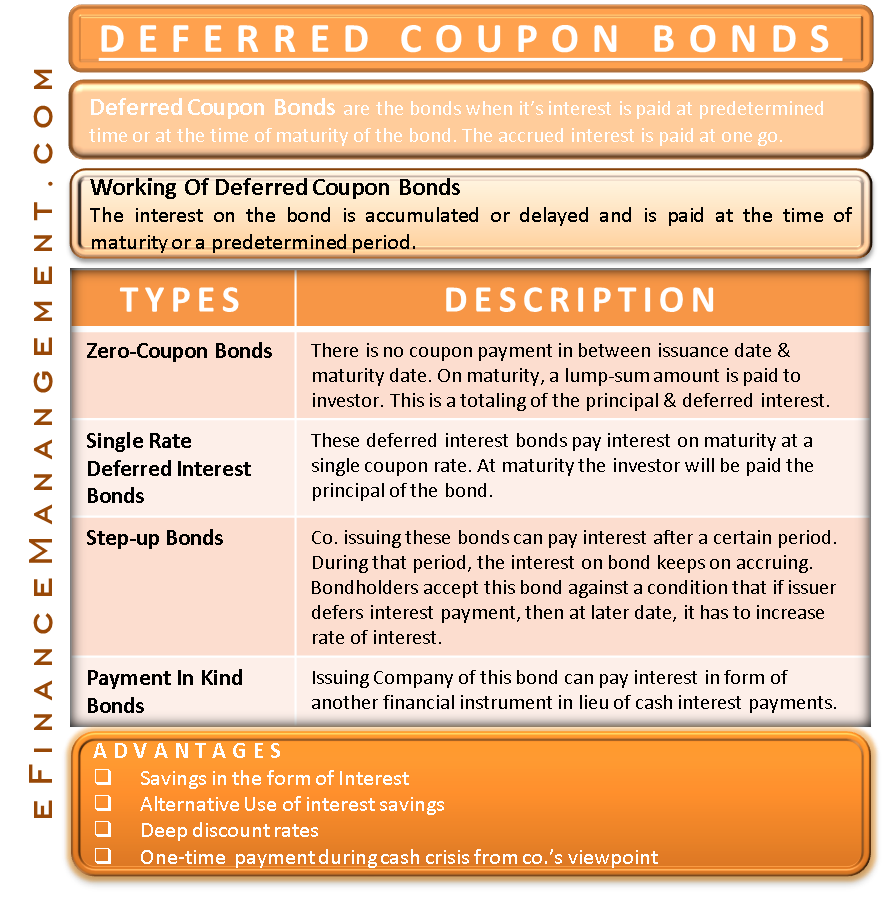

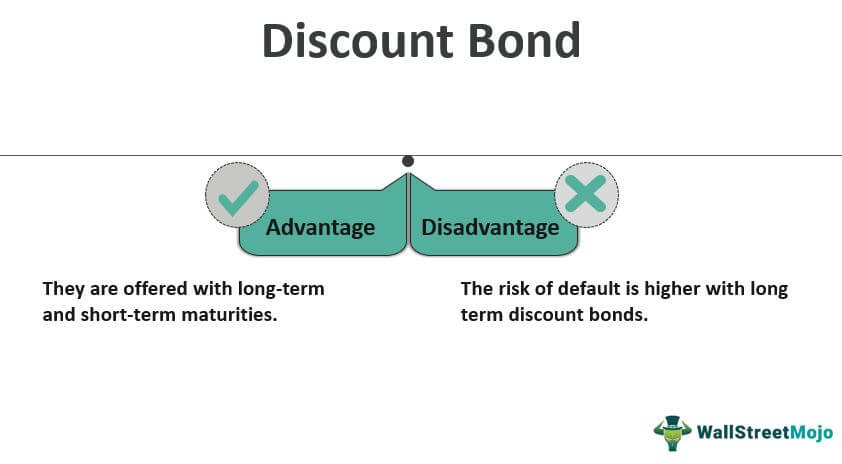

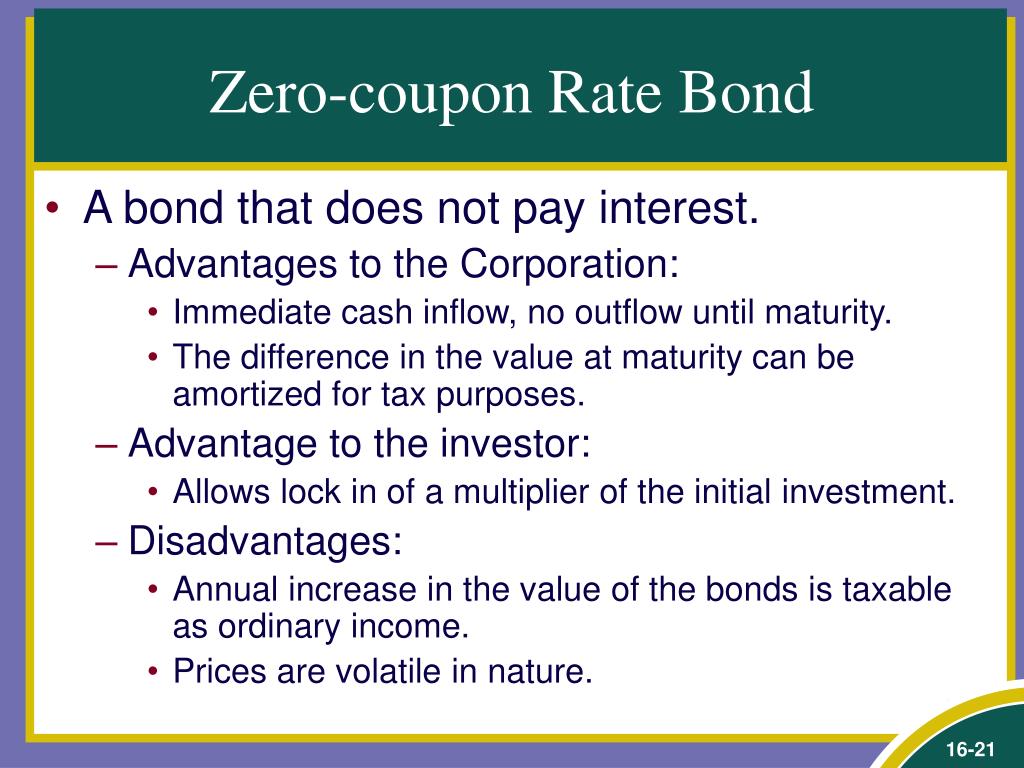

What are Zero Coupon Bonds? | Features, Advantages, Disadvatages Advantages of Zero Coupon Bonds Long-Term in Nature Conservation of Cash No Reinvestment Risk Disadvantages of Zero Coupon Bonds Taxability Loss of Interest Highly Fluctuation Market Prices High Repayment Risk Return of Investors What Is The Advantage Of Investing In A Zero Coupon Bond - Atish Lolienkar Bonds with zero coupons are issued at a discount and redeemed at face value. On such bonds, no interest is paid at regular intervals before maturity. The price at which Zero Coupon Bonds are offered for purchase is substantially lower than the bond's face value. Thus, offering an investor an advantage to begin their investment at low valuations. Unbanked American households hit record low numbers in 2021 Oct 25, 2022 · Those who have a checking or savings account, but also use financial alternatives like check cashing services are considered underbanked. The underbanked represented 14% of U.S. households, or 18. ... Zero-Coupon Bonds: Pros and Cons - Management Study Guide Some of the advantages of these bonds have been mentioned below: Higher Yields: Firstly, zero-coupon bonds are perceived as higher-risk bonds. This is because investors pay money upfront and then do not have much control over it. Also, since the money is locked in over longer periods of time, the perceived risk is more.

The Pros and Cons of Zero-Coupon Bonds - m.finweb.com Here are some of the pros and cons of investing in zero-coupon bonds. Pros One of the big advantages of zero coupon bonds is that they have higher interest rates than other corporate bonds. In order to attract investors to this type of long-term proposition, companies have to be willing to pay higher interest rates. Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Here are the key differences between Zero-coupon Bond and Regular Coupon Bearing Bond Advantages #1 - Predictability of Returns Microsoft is building an Xbox mobile gaming store to take on ... Oct 19, 2022 · Microsoft’s Activision Blizzard deal is key to the company’s mobile gaming efforts. Microsoft is quietly building a mobile Xbox store that will rely on Activision and King games. What are the advantages and disadvantages of zero-coupon bond? What are the advantages and disadvantages of a zero coupon bond? Advantages (a) Growth and (b) avoiding the temptation to trade. That is you put in X$ and get back many times X when you are Y years old. Disadvantages (a) create phantom income. You must pay tax annually on the interest you are not receiving and (b) survival.

Zero Coupon Bonds- Taxability Under Income Tax Act, 1961 - TaxWink The term "Zero Coupon Bond" has been defined by Section-2(48) of the Income Tax Act as below: - ... Further, the most important advantage of the zero coupon bonds is that no tax is payable on interest element if you invest in notified zero coupon bonds. These are subject to capital gains tax only.

What are Zero-Coupon Bonds? (Definition, Formula, Example, Advantages ... From an investor's perspective, zero coupon bonds have the following advantages: They are safe investment instruments and have a lower element of risk involved. Long Dated zero coupon bonds are the most responsive to interest rate fluctuations. Therefore, it might be profitable for the bondholder in the case of a long duration (a higher 'N').

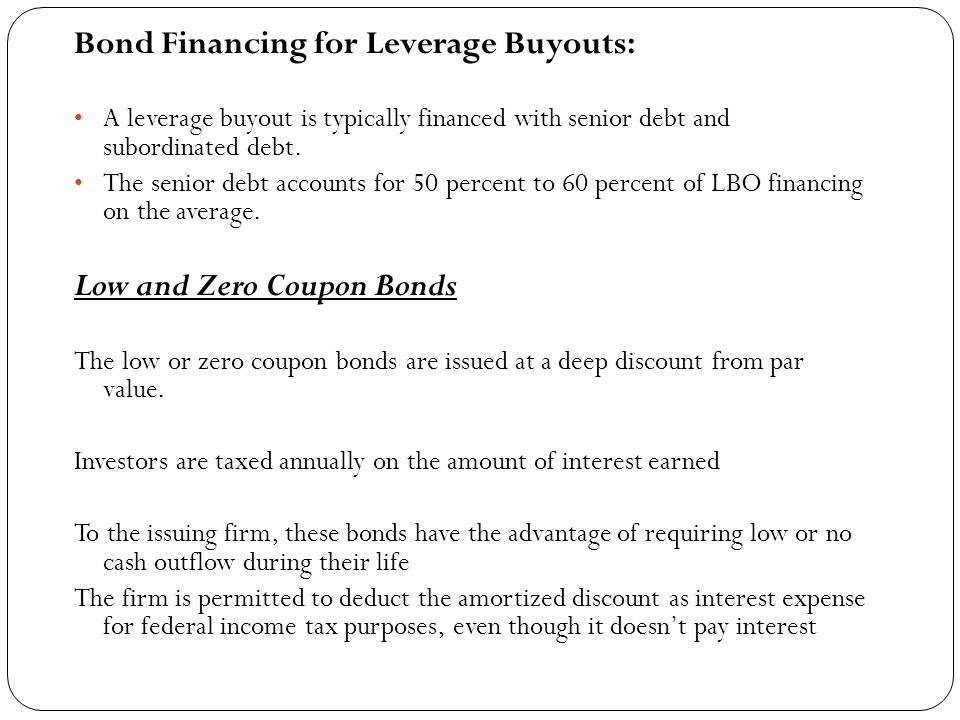

What are the benefits to the issuers of zero-coupon bonds? The zero-coupon designation means that a bond does not pay interest during its life. These bonds are offered at a deep discount off their face value. When the bond matures, the investor will ...

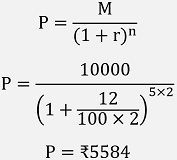

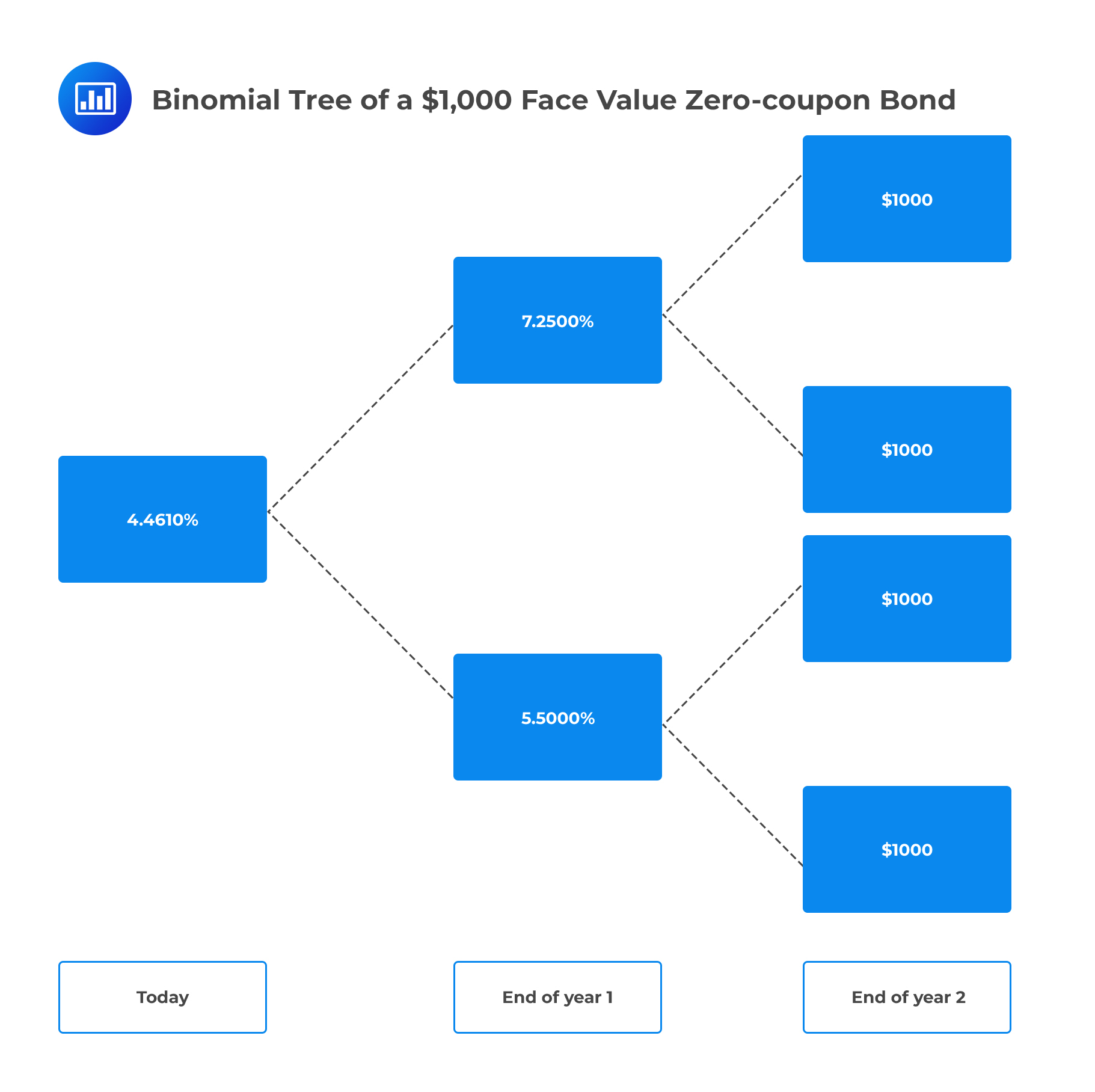

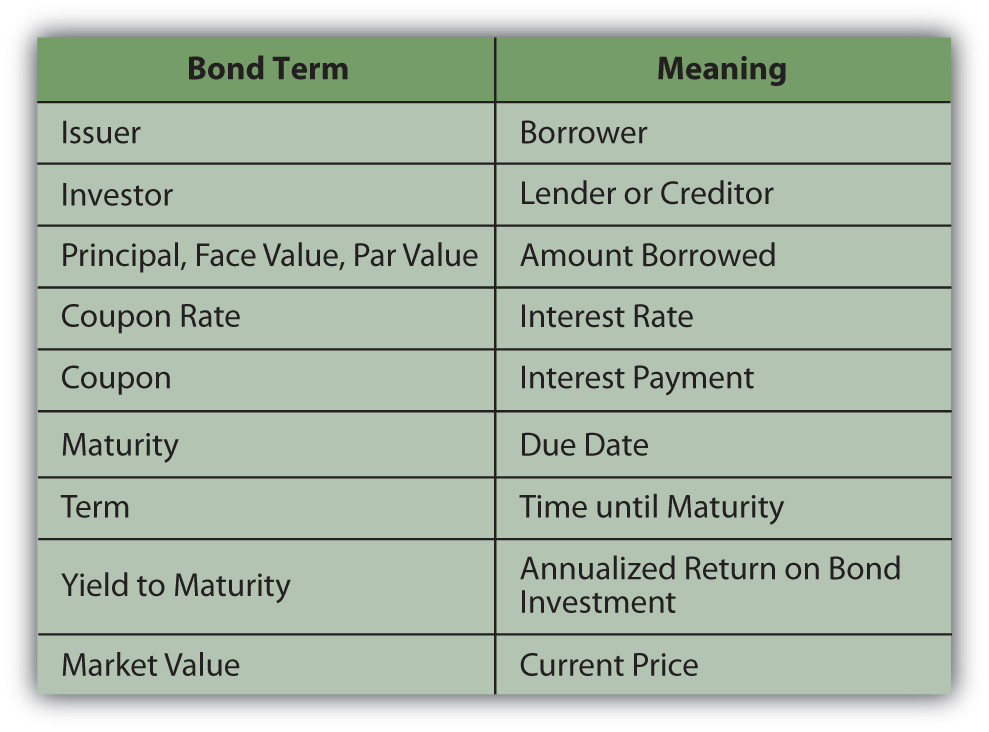

Zero Coupon Bond: Meaning, Features & Advantages - BondsIndia Zero coupon bonds can work to your advantage, if used judiciously and in tandem with your investment objectives. Without any intermittent coupon payments, the calculation of yield to maturity of a zero-coupon bond is as follows: (Face value/ current market price) *(1/years to maturity) - 1;

Zero-Coupon Bond - Definition, How It Works, Formula As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future - an investor would prefer to receive $100 today than $100 in one year.

PlayStation userbase "significantly larger" than Xbox even if ... Oct 12, 2022 · Microsoft has responded to a list of concerns regarding its ongoing $68bn attempt to buy Activision Blizzard, as raised by the UK's Competition and Markets Authority (CMA), and come up with an ...

Zero Coupon Bonds - Taxation, Advantages & Disadvantages - Fisdom Zero coupon bonds come with several benefits. The biggest is the predictability of returns. If an investor does not sell the bond prior to maturity, he/she does not have to worry about market fluctuations since the future value of the investment is known. How do you make money with a zero-coupon bond?

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Unique Advantages of Zero-Coupon U.S. Treasury Bonds Treasury zeros zoom up in price when the Federal Reserve cuts rates, which helps them to protect stock holdings at precisely the right...

What Is a Zero-Coupon Bond? - Investopedia Because they offer the entire payment at maturity, zero-coupon bonds tend to fluctuate in price, much more so than coupon bonds. 1 A bond is a portal through which a corporate or...

Coupon Bond Vs. Zero Coupon Bond: What's the Difference? - Investopedia Zero-coupon bonds are more volatile than coupon bonds, so speculators can use them to profit more from anticipated short-term price movements. Zero-coupon bonds can help investors to...

What is a Zero-Coupon Bond? Definition, Features, Advantages ... Advantages of Zero-Coupon Bond A zero-coupon bond is a secured form of investment when done for the long term. The various benefits it can provide are mentioned below: Predictable Returns: The return on a deeply discounted bond after maturity, is pre-known to the investor in the form of par value or face value.

Success Essays - Assisting students with assignments online We care about the privacy of our clients and will never share your personal information with any third parties or persons.

:max_bytes(150000):strip_icc()/dotdash_Final_Bond_Apr_2020-01-8b83e6be5db3474e896a93c1c1a9f169.jpg)

:max_bytes(150000):strip_icc()/what-are-bonds-and-how-do-they-work-3306235_V3-cc55a8d3b82d4d34a991d6cc4fa8a865.png)

Post a Comment for "38 advantage of zero coupon bonds"