41 zero coupon bonds formula

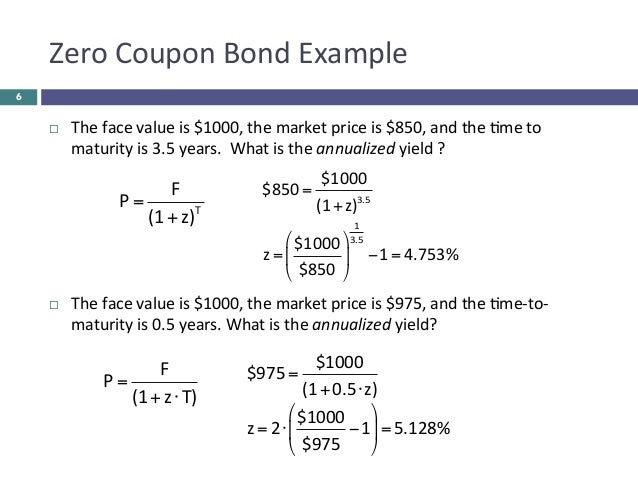

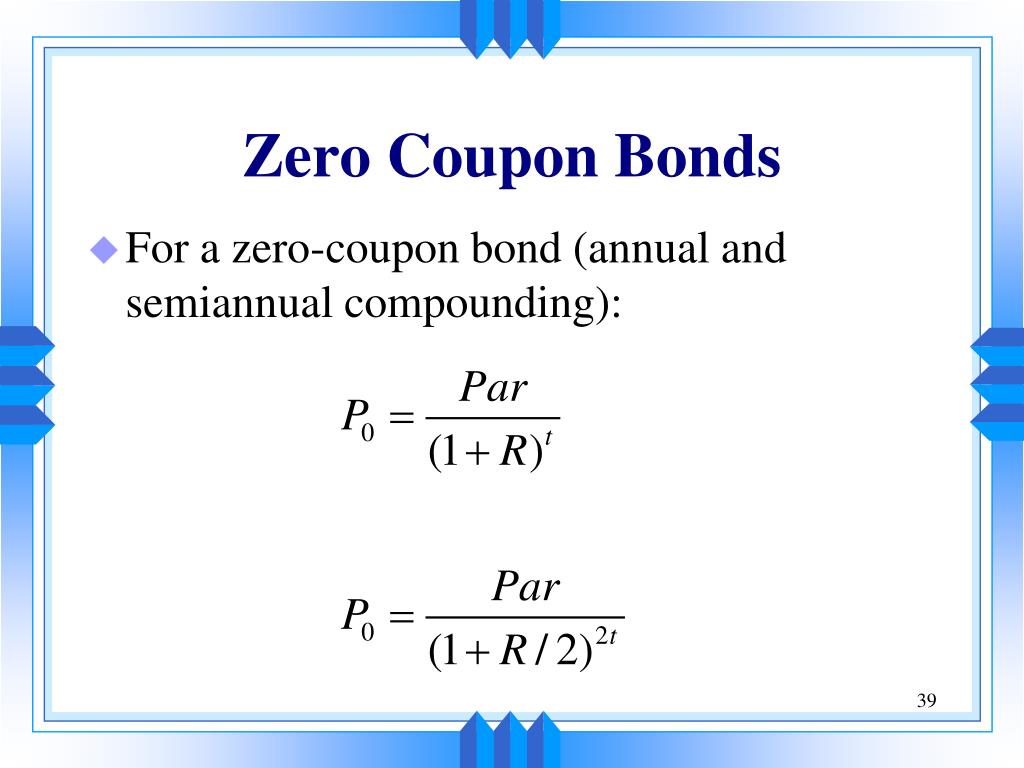

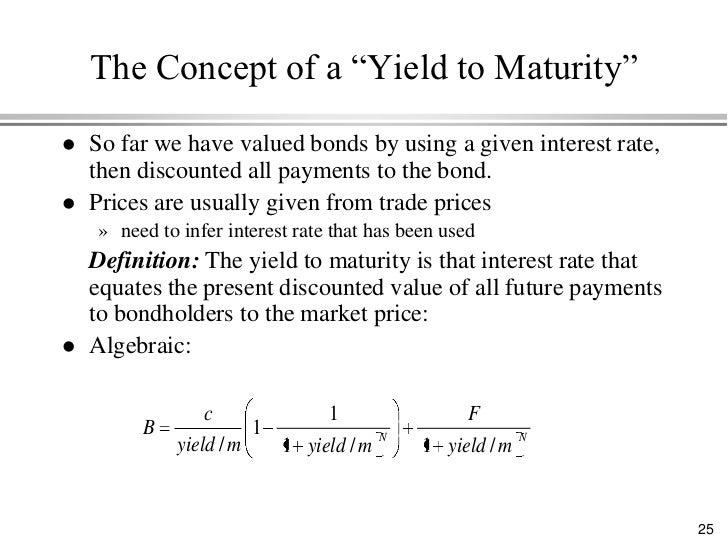

Zero-Coupon Bond: Formula and Excel Calculator Zero-Coupon Bond Value Formula Price of Bond (PV) = FV / (1 + r) ^ t Where: PV = Present Value FV = Future Value r = Yield-to-Maturity (YTM) t = Number of Compounding Periods Zero-Coupon Bond Yield-to-Maturity (YTM) Formula Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest

Zero Coupon Bond: Formula & Examples - Study.com Examples of the Zero-Coupon Bond Formula: Example 1: Annual Compounding. Adam wants to invest in a zero-coupon bond with a face value of $1,000 and 9 years to maturity. If the required interest ...

Zero coupon bonds formula

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Example Zero-coupon Bond Formula. P = M / (1+r) n. variable definitions: P = price; M = maturity value; ... And it's been a tremendous asset, as a matter of fact, since the early '80s, and we have documented that these zero coupon bonds have outperformed the S&P 500 by five times- that's including dividends in the S&P, but a lot of people, they ... Zero Coupon Bond Yield: Formula, Considerations, and Calculation The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Zero-Coupon Bond YTM Example Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. Zero-Coupon Bond: Definition, Formula, Example etc. Price of bond = $1,000/ (1+.07)5 = $713.27 Hence, the price that Robi will pay for the bond today is $713.27. Example 2: Semi-annual Compounding Robi is intending to purchase a zero coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 7% compounded semi-annually.

Zero coupon bonds formula. 14.3 Accounting for Zero-Coupon Bonds - Financial Accounting Identify the characteristics of a zero-coupon bond. ... The present value of $1 at 6 percent in two periods is found by typing the following formula into a cell: =PV(.06,2,,1,0). 2 The entry shown here can also be recorded in a slightly different manner. As an alternative, the liability is recorded at its face value of $20,000 with a separate ... Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. That definition assumes a positive time value of money.It does not make periodic interest payments or have so-called coupons, hence the term zero coupon bond.When the bond reaches maturity, its investor receives its par (or face) value. The One-Minute Guide to Zero Coupon Bonds | FINRA.org Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000. Value and Yield of a Zero-Coupon Bond | Formula & Example Find the value of the zero-coupon bond as at 31 December 2013 and Andrews expected income for the financial year 20X3 from the bonds. Value of Total Holding = 100 × $553.17 = $55,317 Expected accrued income = Value at the end of a period − Value at the start of a period = $55,317 − $50,000 = $5,317

Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter The formula is mentioned below: Zero-Coupon Bond Yield = F 1/n PV - 1 Here; F represents the Face or Par Value PV represents the Present Value n represents the number of periods I feel it necessary to mention an example here that will make it easy to understand how to calculate the yield of a zero-coupon bond. Yield to Maturity Calculator - Calculate YTM for Bonds Additionally, you could use the formula for coupon-yielding bonds and simply enter the coupon rate as zero. Example In this example, we will use a zero-coupon bond with the same variables as the last example—its time to maturity is 10 years, the present value of the bond is $1,000, and the future value of the bond is $1,100. Zero-Coupon Bond - Definition, How It Works, Formula Price of bond = $1,000 / (1+0.05/2) 5*2 = $781.20 The price that John will pay for the bond today is $781.20. Reinvestment Risk and Interest Rate Risk Reinvestment risk is the risk that an investor will be unable to reinvest a bond's cash flows (coupon payments) at a rate equal to the investment's required rate of return. Coupon Bond Formula | Examples with Excel Template Coupon Bond Formula - Example #1. Let us take the example of some coupon paying bonds issued by DAC Ltd. One year back, the company had raised $50,000 by issuing 50,000 bonds worth $1,000 each. The bonds offer coupon rate of 5% to be paid annually and the bonds have a maturity of 10 years i.e. 9 years until maturity.

Zero Coupon Bond Yield - Formula (with Calculator) The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as This formula will then become By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ The zero coupon bond price formula is: \frac{P}{(1+r)^t} where: P: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Zero Coupon Bond Yield: Formula, Considerations, and Calculation The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Zero-Coupon Bond YTM Example Consider a... Zero-Coupon Bond Definition - Investopedia If the debtor accepts this offer, the bond will be sold to the investor at $20,991 / $25,000 = 84% of the face value. Upon maturity, the investor gains $25,000 - $20,991 = $4,009, which translates...

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

Zero Coupon Bond | Investor.gov The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years. These long-term maturity dates allow an investor to plan for a long-range goal, such as paying for a child's college education. With the deep discount, an investor can put up a small amount of money that can grow over many years.

Zero-Coupon Bond - Definition, How It Works, Formula Calculating the price of zero coupon bond: The yield to maturity formula can be used to calculate the present value of the bond. By rearranging the above formula, the present value of the bond can be calculated as where, PV = Present value of bond FV = Face value of bond (Future value) YTM = Yield to maturity t = Time to maturity

Zero Coupon Bond Value - Formula (with Calculator) Example of Zero Coupon Bond Formula A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Zero Coupon Bond Default Formulas - quantwolf.com Default probability in terms of yield. p = 1 − α 1 − R α = 1 + y 0 T 360 1 + y 1 T 360 y 1 = yield of the bond y 0 = yield of the risk free bond T = number of days to maturity R = recovery rate, between 0 and 1.

How to Buy Zero Coupon Bonds | Finance - Zacks The bonds are sold at a deep discount, and the principal plus accrued interest is paid at the bond's maturity date. The less you pay for a zero coupon bond, the higher the yield. A bond with a ...

Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The formula above applies when zero-coupon bonds are compounded annually. When interest is compounded semi-annually, the same formula will be used, but the number of years will be multiplied by 2. A zero-coupon bond earns interest that is only imputed, which means the interest is merely an estimate instead of an established rate.

Zero Coupon Bond Value Formula - Crunch Numbers Example of price of a zero-coupon bond calculation Let's assume an investor wants to make 10% of return on a bond. The face value of the bond is $10,000. The bond is redeemed in 5 years. What price the investor would pay for this bond? M = $10,000 r = 10% n = 5 katex is not defined

Zero Coupon Bond | Definition, Formula & Examples Feb 18, 2022 — The basic method for calculating a zero coupon bond's price is a simplification of the present value (PV) formula. The formula is price = M / (1 ...

How to Calculate the Yield of a Zero Coupon Bond Using Forward Rates? So We have 1.07. So we're gonna multiply 1.07 by the next term (1 + the forward rate) rate for year two. What's the forward rate for year two? It's 6.8%. So we're just taking (1 + the forward rate) for each of these periods. It's a five-year zero-coupon bond so we're gonna go all the way up to forward rate through year five.

Zero-Coupon Bond: Definition, Formula, Example etc. Price of bond = $1,000/ (1+.07)5 = $713.27 Hence, the price that Robi will pay for the bond today is $713.27. Example 2: Semi-annual Compounding Robi is intending to purchase a zero coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 7% compounded semi-annually.

Zero Coupon Bond Yield: Formula, Considerations, and Calculation The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Zero-Coupon Bond YTM Example Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today.

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Example Zero-coupon Bond Formula. P = M / (1+r) n. variable definitions: P = price; M = maturity value; ... And it's been a tremendous asset, as a matter of fact, since the early '80s, and we have documented that these zero coupon bonds have outperformed the S&P 500 by five times- that's including dividends in the S&P, but a lot of people, they ...

Post a Comment for "41 zero coupon bonds formula"